Last Friday the Bureau of Economic Anaysis (a federal government bureau) issued their corrected GDP numbers for the last several years. This post uses this updated data to begin the first of a few posts on Growth in a time of Debt.

Chart 1: BEA Quarterly Annualized Seasonally adjusted US GDP growth, 2005q1 thru 2010q2

_____________

The Excel generated trend line for real GDP growth in this Chart 1 period is shown crossing the "no growth" line. Clearly the trend line in this particular period is heavily influenced by the sharp contraction in 2008-2009, so in the next chart, Chart 2, I have considered a much longer period.

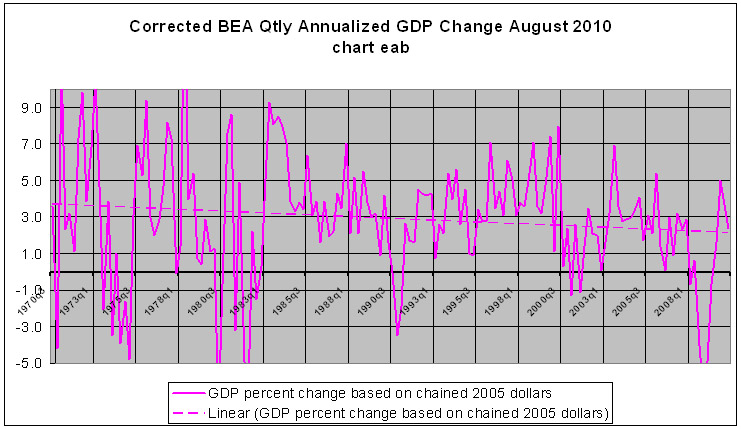

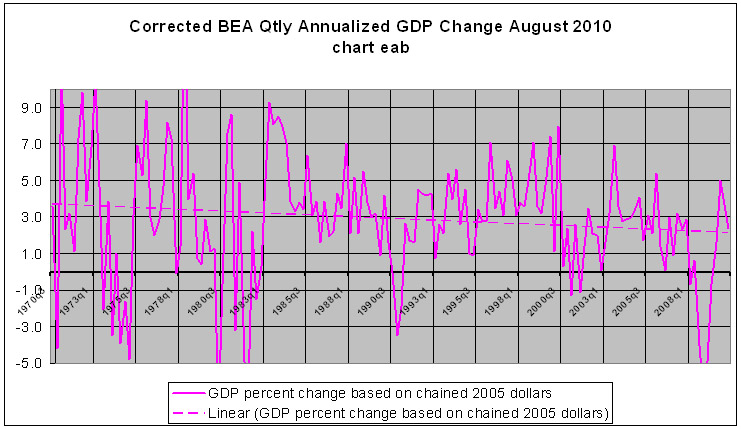

Chart 2 shows real growth for four decades. Clearly the sharp growth contraction in 2008 is not a unique event. Note that for this long period the trend line tends towards 2% growth, not zero.

Chart 2: Real US GDP growth from Q1 1970 thru Q2 2010

_______________

In Chart 3 below I go back to Chart 1 and remove the years 2008 and 2009. I then look at the dozen years of part Clinton and part Bush -- the years between 1995 and 2007 -- thus eliminating the most recent financial crash, Nixon's gold shock, the Carter stagflation, and Reagan's voodoo economics. Here too the trend is towards a 2% real GDP growth rate.

Chart 3 US real GDP growth is trending towards 2%

__________________

Now let's look at the growth of debt -- see Chart 4.

For the last four decades American banks, corporations, consumers and the federal government, in total, have been racking up massive quantities of debt. This debt has been necessary to fund wars, maintain the American way of life, and in recent years, to finance the plunder of the world by TBTF American banks.

Every year we borrow money to increase our debt, increases our consumption (demand), and hence increases GDP. Every year we decrease debt (pay off debt) decreases demand and thus lowers GDP. There is a direct correlation between the rate of growth of debt and the rate of growth of GDP.

Our total debt in most years has been growing at about twice the rate of GDP growth (Chart 4 below). In the last decade the total debt growth rate has been closer to three times the GDP growth rate. In the last couple of years it has been closer to four times the GDP growth rate.

Households (mortgages) and banks (securitized mortgages and derivatives) have been

the primary causes of this debt explosion. Growth of business and federal debt has been pretty much in line with GDP growth.

Chart 4 shows the current dollar percentage growth rate of US GDP and total US debt during the last four decades.

This rather long winded, chart ridden explanation leads me to my conclusions about near term US real GDP growth.

My position on US GDP growth and debt is that:

The Republicans have no plan. They appear to believe that reducing taxes and cutting government spending will provide enough stimulus and that the American economy will resume strong growth through the invisible hand of the market. If only the government would get out of the way, they appear to be saying, the invisible hand will assert itself and the economy will recover.

And below, Chart 5, is my interpretation of Obama's gift to the American people from his budget Tooth Fairy. There is no budget forecast for what is going to happen to "Total Debt", but there is a forecast for federal debt in the FY2011 Budget, so I have charted just the federal debt growth and GDP growth.

In simple English, translated from the picture above, here is the Tooth Fairy story:

Chart 1: BEA Quarterly Annualized Seasonally adjusted US GDP growth, 2005q1 thru 2010q2

_____________

The Excel generated trend line for real GDP growth in this Chart 1 period is shown crossing the "no growth" line. Clearly the trend line in this particular period is heavily influenced by the sharp contraction in 2008-2009, so in the next chart, Chart 2, I have considered a much longer period.

Chart 2 shows real growth for four decades. Clearly the sharp growth contraction in 2008 is not a unique event. Note that for this long period the trend line tends towards 2% growth, not zero.

Chart 2: Real US GDP growth from Q1 1970 thru Q2 2010

_______________

In Chart 3 below I go back to Chart 1 and remove the years 2008 and 2009. I then look at the dozen years of part Clinton and part Bush -- the years between 1995 and 2007 -- thus eliminating the most recent financial crash, Nixon's gold shock, the Carter stagflation, and Reagan's voodoo economics. Here too the trend is towards a 2% real GDP growth rate.

Chart 3 US real GDP growth is trending towards 2%

__________________

Now let's look at the growth of debt -- see Chart 4.

For the last four decades American banks, corporations, consumers and the federal government, in total, have been racking up massive quantities of debt. This debt has been necessary to fund wars, maintain the American way of life, and in recent years, to finance the plunder of the world by TBTF American banks.

Every year we borrow money to increase our debt, increases our consumption (demand), and hence increases GDP. Every year we decrease debt (pay off debt) decreases demand and thus lowers GDP. There is a direct correlation between the rate of growth of debt and the rate of growth of GDP.

Our total debt in most years has been growing at about twice the rate of GDP growth (Chart 4 below). In the last decade the total debt growth rate has been closer to three times the GDP growth rate. In the last couple of years it has been closer to four times the GDP growth rate.

Households (mortgages) and banks (securitized mortgages and derivatives) have been

the primary causes of this debt explosion. Growth of business and federal debt has been pretty much in line with GDP growth.

Chart 4 shows the current dollar percentage growth rate of US GDP and total US debt during the last four decades.

This rather long winded, chart ridden explanation leads me to my conclusions about near term US real GDP growth.

My position on US GDP growth and debt is that:

- With sufficient government stimulus, and with the beginnings of financial reform, real average annual GDP growth will be in the region of about 2%/year.

- For several reasons which I will describe in future posts I believe that an average of about 2.5% real GDP growth will be about the maximum rate we will ever achieve in the foreseeable future, even under optimal conditions .

- Any US administration admitting to and planning for such an anemic long term growth rate would send shock waves around the world. No US administration could possibly accept such a possibility and remain in office.

- Without debt write offs and without enough immediate government stimulus, and various other government actions, real GDP growth will stall, with GDP growth approaching zero in a few (less than 5) years.

- It is highly unlikely that any American political party can, or will even attempt to implement the very tough actions needed to maintain something in the region of a consistent 2% growth rate.

- As a consequences of items 3 and 5, no US administration, in the foreseeable future, will lay out the stark choices facing the American people.

- It is likely that in the absence of war, US unemployment will have to be in the region of about 25% before any political action is possible. Even then the solution chosen is not predictable. WWII was the mother of all job creation programs, and every American politician knows it.

The Republicans have no plan. They appear to believe that reducing taxes and cutting government spending will provide enough stimulus and that the American economy will resume strong growth through the invisible hand of the market. If only the government would get out of the way, they appear to be saying, the invisible hand will assert itself and the economy will recover.

And below, Chart 5, is my interpretation of Obama's gift to the American people from his budget Tooth Fairy. There is no budget forecast for what is going to happen to "Total Debt", but there is a forecast for federal debt in the FY2011 Budget, so I have charted just the federal debt growth and GDP growth.

In simple English, translated from the picture above, here is the Tooth Fairy story:

- Imprudent, feckless Mr Clinton reduced the rate of federal debt growth so much, that in 1998 federal debt began to disappear.

- Three years later in 2001, America was attacked by nasty Mr OBL because nasty Mr OBL hated how Americans lived -- all free and all.

- So, brave, peace loving Mr Bush was forced to go to war. Oh how Mr Bush hated war!

- Because poor peace loving Americans, who never attacked any body, ever, didn't have enough weapons, and because King Bill Clinton taxed the citizens so much, nice brave Mr Bush did not have enough money to defend America.

- Nice Mr Bush had to reduce King Bill Clinton's taxes, because everyone knows that's how you get more money to do good things, and taxes oppress people.

- But things did not work out quite that way and nice Mr Bush had to borrow lots of money to rearm America to protect the people he loved, and had sworn to protect, from nasty Mr OBL. Oh if only feckless imprudent Mr Clinton had borrowed more money to defend America, and if only silly Mr Clinton had not increased taxes, Mr Bush would not have had to borrow so much money to defend the people he loved.

- And then peace loving Mr Bush was threatened by dreadful Mr Hussein with his nasty germs and WMDs 'nall. And again Mr Busn had to borrow more money to defend the people he loved

- And that is why Mr Bush had to increase the growth rate of federal debt from Mr Clinton's silly -5% a year in 2000, to 30% a year in 2009.

- But never fear, clever Mr Obama has replaced overworked Mr Bush. Like Mr Bush, Mr. Obama also went to Harvard. Mr Obama knows how to hire the right people to solve problems. Mr Summers and Mr Geithner and Mr. Bernanke are on the job and they have the problem almost solved.

- Next year (2011) the federal debt will increase by only 12% and two years from then (2013) the federal debt will increase by only about 8%, very near the GDP growth of about 7% and by 2015 the problem will almost be solved.

- How, you ask? The answer is so obvious that if you have to ask, you wouldn't understand the solution anyway.

No comments:

Post a Comment