I wanted to take a brief break from talking about debt as a drag on US economic growth.

So... here are a few words and a few pictures about oil, an even more fundamental limitation than US debt, on world and US economic growth.

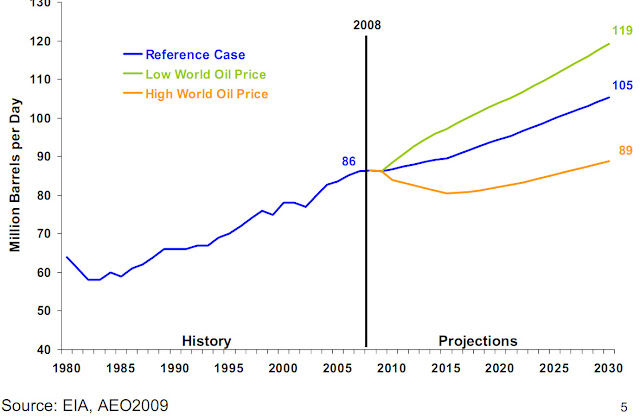

Chart 1: Chart from an EIA Energy Conference in April 2009 from a presentation by Sweetnam________________

In chart 1 please focus on the EIA forecast for world oil demand and supply in 2020, just a decade from now. It shows a demand for 90+ million barrels of oil per day. It also shows that about 20mbd of the required supply to meet that demand, must come from yet to be identified projects.

Chart 1 looks like it was put together by a "peak oiler".

Who are we? Peak oilers are people, like me, who believe that the supply of oil is finite, that we have used up about half the world's total oil supplies, that the "energy cost" of procuring more oil is increasing rapidly because the "easy to find" oil has been found, and that the price of oil will rise as the "energy returned on energy invested" (the EROEI) continues to increase.

I believe world economic growth depends on the supply and price of available energy, and on the ingenuity of our species to conserve the fossil fuels now left in the ground, and on our ability to exploit new energy sources.

A strong case can be made that we are now (for the next half decade) in an upwardly moving but oscillating oil price regime, where the price of oil will decrease as the oil price (and other factors) slow world economic growth, and thus the demand for oil. I also believe the price of oil will increase as each impediment to growth is resolved, which leads to another oil price increase and so on. Complicating all this is the inexorable depletion of current oil fields.

I am in the camp that believes we are long past the time where we could have, if we ever could have, replaced the liquid fossil fuel energy demanded by BAU growth, with liquid fuel substitutes.

The days of extraordinarily cheap oil have gone forever, and there are no substitutes capable of replacing the combination of qualities which were once available from $10/barrel oil.

For many reasons, not least of which is the increasing price of liquid fuels, world economic growth is slowing, and will continue to do so into the foreseeable future. The rate of growth of the "developed countries" will be the most impacted..

Our leaders know this very well. Hence the hundreds of US military installations dotted around the main oil supplying regions and routes in the world.

We entered the age of post WWII oil "hot wars" when Americans invaded Afghanistan and Iraq. I suspect we would now be involved in a hot war with Iran if Obama had not been elected. We probably will anyway!

Enough gloom.

Below, to ground us in reality. is a chart of historical oil prices from 1970 through 2009 (Chart2). We are now, again, in mid 2010, in the region of $70-$80/barrel -- and we are still in a recession. Will demand for oil return when the recession ends?

Chart 2 Oil Price History from WTRG Economics

_________________

Let's take a look at what the people who are paid to think about these things are saying. Let's see what the US Energy Information Administration (EIA) says.

The EIA, an agency of the federal government, was created during the Carter administration. Like most of the energy and other science related federal agencies, the EIA was hijacked by the Bush administration and became a pawn of the Cheney energy cabal. Under Obama and Chu the EIA is showing some signs of resuscitation.

Now please see charts 3 and 4 below to see what, in 2010, the EIA is forecasting for the next two to three decades.

The demand for about 90+ million barrels/day is the EIA "reference" case, in which the price in 2020 hovers around $120/barrel. The EIA models see a demand for about 110mbd if the price is in the region of $50/barrel, and about 80mbd if the price is closer to $180/barrel. These price and consumption cases are shown in Charts 3 and 4 below.

Chart3 EIA, Sweetnam

___________________

--__Chart_4_EIA Sweetnam_______________

In 2007, the EIA demand forecast in the reference case called for 105mbd in 2020. The most recent EIA forecast in 2010, three years later, now calls for only 92mbd in the same year, 2020 -- a reduction of 13 mbd (about 13%) in three years.

_Chart 5__Chart from Econbrowser__________________

From the charts above we can conclude that the EIA forecasts say or imply:

- A bias towards a continually reducing forecast for oil consumption as the future unfolds

- A current "most probable" consumption of about 92mbd in 2020 bounded by approximately +/- 10mbd

- A current "most probable price of about $120/barrel in 2020 bounded by about +/- about $60/barrel

With that in mind, let's now look one level deeper and very briefly discuss some of the details, context and implications of these numbers as they affect certain areas of the world.

__Chart 6_EIA IEO 2010_____________

Chart 7 EIA IEO 2010

_________

Chart 6 says (see the last column) that the economies of the Middle East will grow at a rate 50% faster than the US (3.8% vs 2.4%) and that India and China will grow more than twice as fast as the US (about 5.5% vs 2.4%) . Neither statement is very surprising.

But here is the tough part: In Chart 7 the EIA model says that the demand for oil in China will grow at a rate more than ten times (1500%!) faster than the demand in the US, and that the demand for oil from the Middle East and India will grow at about 10 times the rate of the US.

If that turns out to be anywhere near what actually happens, the demand for oil from India, China and the Middle East will become a matter of life and death for them and they will brook no interference from America or anyone else in their attempts to procure the life sustaining liquid fuel they need.

Let's now see how a picture of a somewhat longer term history (1980), projected out till 2020 just a decade from now. Chart 8 is such a chart based on EIA data and 2010 forecasts

_Chart 8. World Oil Consumption (EIA) and forecast from EIA International Energy Outlook_2010. Note that the "World" consumption line data has been divided by three to make the scales reasonable. World oil consumption in 2000 was in the region of 78mbd.

__________________

Chart 8 illustrates that, according to the EIA model, in 2020 which is only a decade away:

- China and Europe will be consuming oil at the rate of about 12-14mbd each, with the Middle East consuming about 8mbd.

- European usage will continue falling through 2020 although their economies will continue growing slowly, whereas China's oil consumption will continue rising rapidly as its GDP continues rising rapidly.

- The US will have turned around its falling consumption and US oil consumption will be back to about 2005 levels as US GDP grows by 50% between 2009 through 2020.

- Total world consumption will reach about 92mbd

- US GDP grows by 50% in 10 years while American oil consumption returns to the 2005 level.

My own bet is that

- Between 2007 and 2020, US GDP will grow at a rate much less than the 2.4% CAGR predicted in Chart 7

- Between 2010 and 2015 Americans will continue to elect representatives who promise them a "return to growth"

- Slow growth will lead to increased social dysfunction as Americans attempt to achieve the impossible -- to increase, or even maintain the huge gap in consumption which separates them from the rest of the world

- It may take a horribly destructive war to convince Americans, as it did Europeans half a century ago, that the era of western colonialism, begun with the era of western exploration half a millenium ago, is finally over.

No comments:

Post a Comment